Hi all 👋

First, a correction from the last edition: I originally included discussion of a recent TX ruling around the CFPB’s 2017 payday lending rule. That recent ruling was focused on the “payments provisions” of the 2017 rule, which prohibits payday lenders from trying to debit accounts after failures, not the ability to repay part. As of earlier this year, the ability to pay rule was still being litigated.

Also, ugh, fewer memes and gifs than I’d like again. Sorry, just too much interesting stuff going on.

CSBS Community Bank Report

As is often the case, the update I thought would interest me the least ended up being my favorite...

CSBS (a group of state bank regulators) released its annual report on the state of community banks. Let’s take a stroll through some highlights…

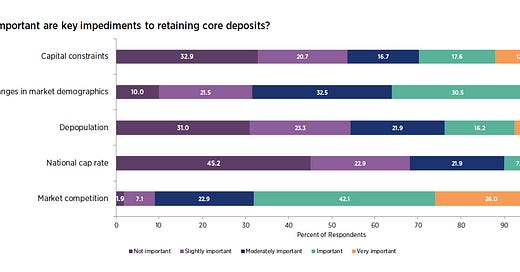

For community banks, market competition was the most important factor in retaining deposits, which could speak to the growth of neobanks like Chime:

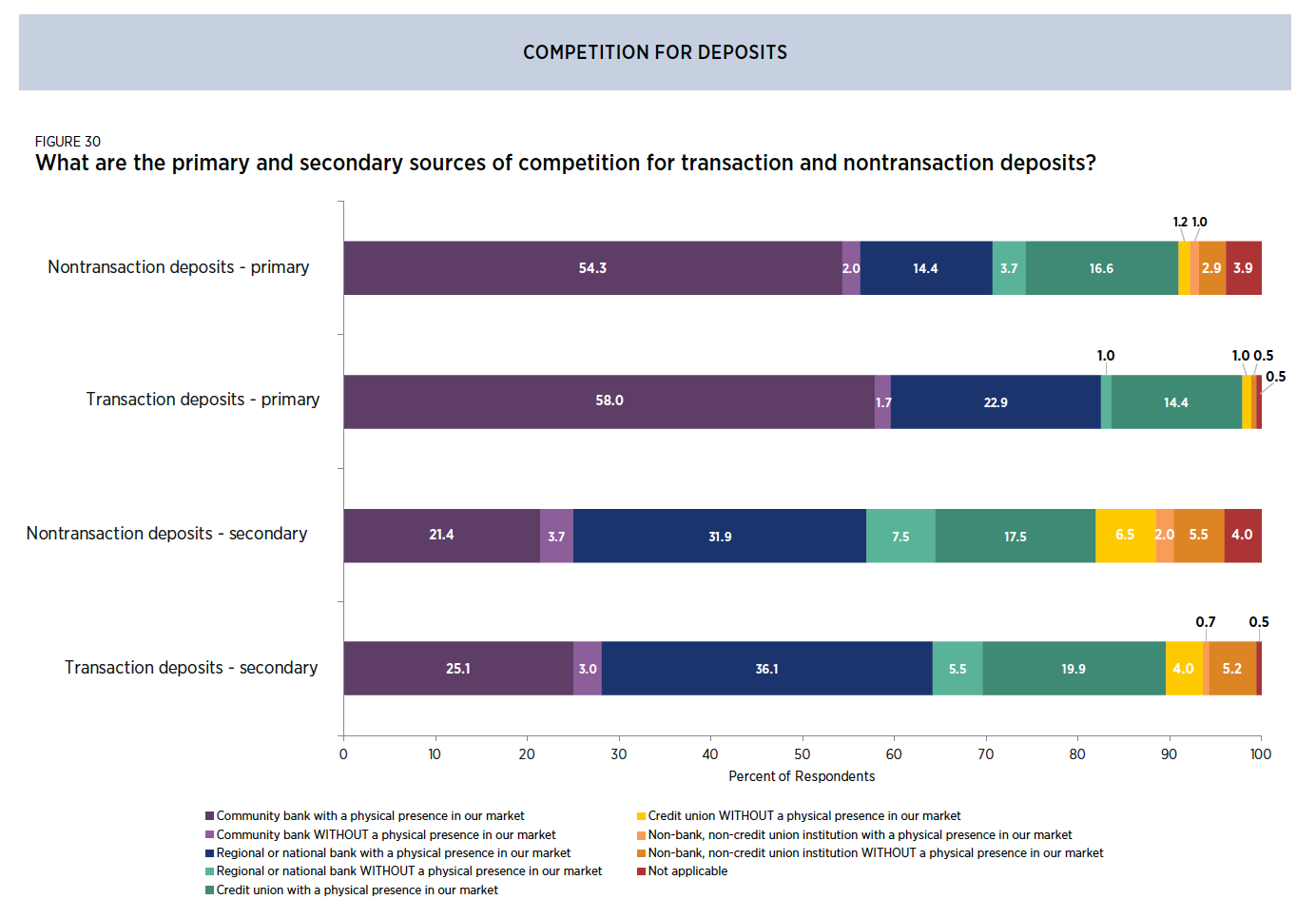

BUT community banks don’t seem to perceive “non-banks” (i.e., a group including most FinTechs) as a big threat to transactions and deposits: only around 4% and 7.5% of community banks consider “non-banks” to be a primary or secondary competitor, respectively.

Community banks seem to believe non-banks pose more of a threat for lending...but primarily in agriculture, and to a lesser extent, mortgages. Definitely not in business lending (like, oh, I dunno, BlueVine, Square Capital, etc.):

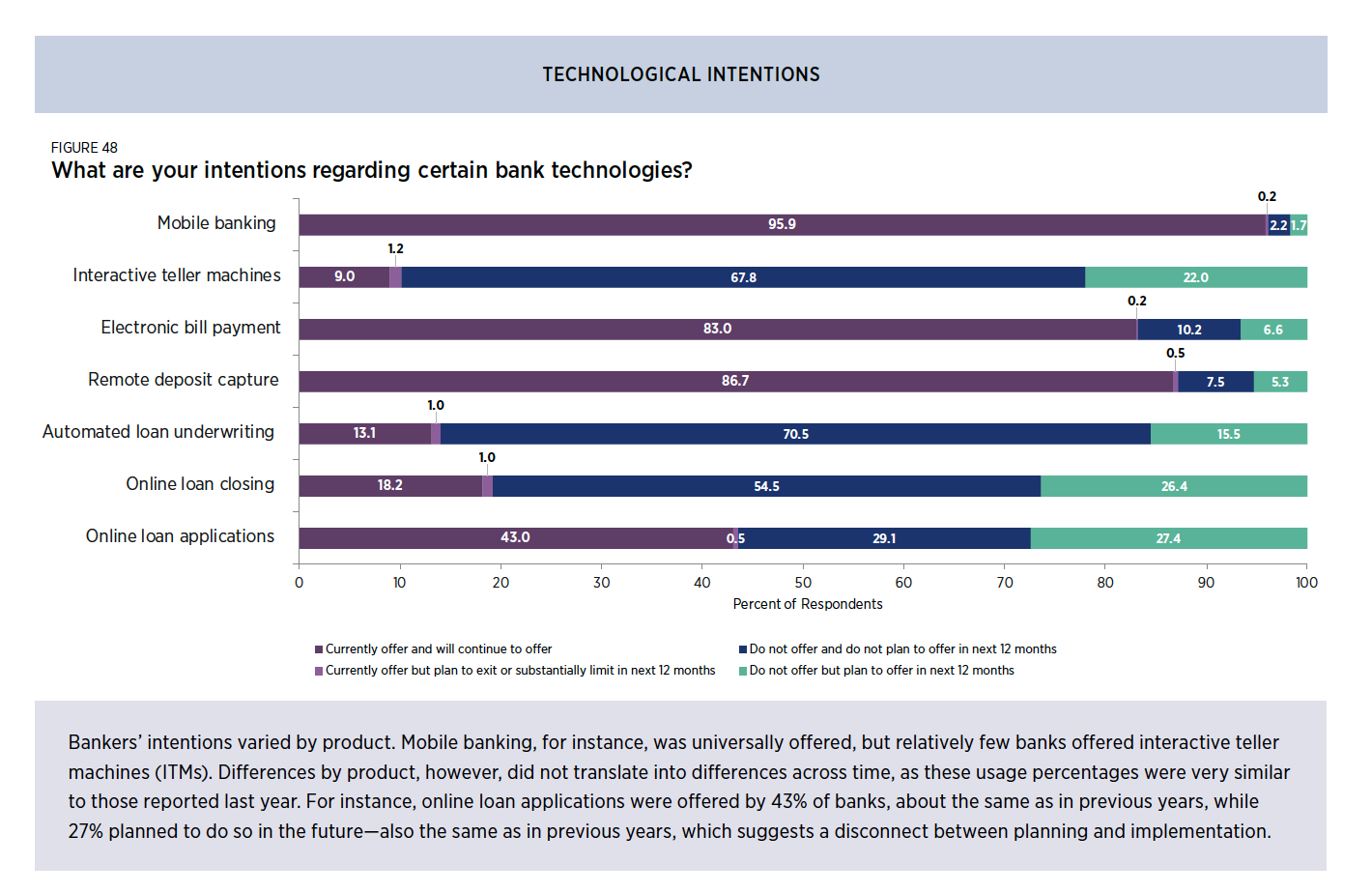

And then there’s this fun chart, showing:

Mobile banking, electronic bill pay, and remote deposit seem to be an existing priority for most community banks.

But 70.5% of responding banks said they don’t and won’t offer automated loan underwriting.

The survey results cover a lot I won’t mention (e.g., how community banks feel about their core processing tech). But I highly recommend at least skimming it if you work with or compete against community banks.

Chopra to Lead CFPB

Rohit Chopra was confirmed as director of the CFPB. Chopra spent the last three years at the FTC, but he’s no stranger to the CFPB. He helped set the bureau up, and served as the agency’s first Student Loan Ombudsman and an Assistant Director.

What we can expect:

While Chopra may not be the coolest Rohit in FinTech, he is generally known as a fierce consumer advocate and Wall Street critic.

The CFPB’s already taking a more aggressive approach, but you can expect Chopra to prioritize issues like payday lending, student lending, and credit reporting errors.

Omarova’s OCC Nomination

President Biden nominated Saule Omarova to be the next Comptroller of the Currency.

First off, what even is the Comptroller?

The Comptroller is the primary regulator for national banks, but she or he can also influence state banks.1 And the OCC has been a guiding force in recent interagency proposals about how banks should think about their (FinTech) partners.

Omarova is a Cornell Law professor and a bit controversial so it’s TBD if she can actually get enough votes in the Senate.

To give you an idea, here are some of the themes she’s promoted in her academic papers:

Give more weight to public interest factors.

Regulation should be more proactive by requiring pre-approval for any new financial services.

A shift away from “micro” regulation (focused in specific activities and entities) to more of a “macro” approach, where regulators can regulate entities based on their overall effects to markets and society.

Government-owned “golden shares” that give regulators the right to override management in public corporations.

Most of her papers’ views are more theory than practice, and would require unlikely legislation. But some practical implications if Omarova is approved:

Novel bank charter options will be less likely, and the existing crypto trust charter option (e.g., Paxos) could be threatened.

Big tech companies getting into banking will face more scrutiny from the OCC.

More aggressive OCC views on bank-FinTech partnership standards.

If you want more, Arthur Long at Gibson Dunn has a really nice summary of themes from Omarova’s work.

Stablecoin Proposals

The Biden administration is considering imposing bank-like regulations on stablecoin issuers via two main options:

Requiring stablecoin issuers to register as banks, or

The Financial Stability Oversight Council (FSOC).

The first approach would likely require new legislation. The second one is more interesting to me.

FSOC was established after the 2008 crisis as a tool to monitor broader financial system threats. It’s is made up of the heads of all the main US financial regulators (SEC, Fed, OCC, CFPB, etc).

FSOC’s most notable tool is they can declare an institution “systemically important,” which makes it subject to elevated risk management standards and increased oversight (e.g., reporting).

So, for example, if FSOC designating stablecoin provider Circle as systemically important, Circle could be subject to reserve requirements and/or reporting obligations.

The FSOC approach would likely be overbroad…but if Biden wants to regulate stablecoins, it’s probably a more likely path than passing new legislation, and would probably be a more flexible way to manage a still-evolving tech.

CFPB Demographics

The CFPB released a report on complaint demographic patterns, finding:

Complaints from wealthier or whiter communities were more frequently about loan origination and loan servicing issues.

Complaints from communities of color and lower-income communities were more frequently about credit reporting, identity theft, and delinquent servicing.

That difference is not unsurprising and speaks to the societal dragons FinTech can still help slay.

CFPB Sues Credit Repair Co.

The CFPB sued Credit Repair Cloud:

The company didn’t directly sell credit repair services; it sold the software and tools that other companies could use to offer consumers credit repair services.

The company enabled and promoted charging an upfront fee.

Buuuuut the Telemarketing Sales Rule prohibits credit repair businesses that telemarket from taking any fee until they’ve provided a consumer report showing the promised credit improvement.

We seem to be talking a lot about a credit repair industry scrutiny lately, and you can expect the CFPB to be continually focused on it under Chopra.

Elsewhere (non-crypto)...

📝 More evidence that “it’s expensive to be poor” in the US: Here’s a Brookings report on how digital payments are easier and less expensive for those with more wealth, and exploring how the inability to access digital payments may impact health.

📝 Speaking of slaying dragons, TrueAccord put out a good guide on (humanely) improving debt collection. Worth a skim if you touch collections at all.

🧑🏽🤝🧑🏿 NASAA (a group of state securities regulators) approved a statement on diversity, equity, and inclusion goals to guide the association.

📝 NY released proposed regs for its commercial disclosure page law.

🏦 “Bank Mergers Are On Track to Hit Their Highest Level Since the Financial Crisis.”

🔎 The SEC proposed a reporting form change to increase transparency around how fund managers vote using shareholder proxies.

💰 Another huge trove of offshore tax haven docs, the Pandora Papers, was leaked and is rolling out this week. This one is larger that past leaks and implicates far more jurisdictions (including, for example, the use of South Dakota as a wealth shelter).

🤓 Here’s a great TL;DR on US financial regulators from Mihail Eric.

Elsewhere (crypto)...

🚫 China banned crypto. Again. For the umpteenth time. But this one might be working.

🕵️ The Department of Labor’s Acting Assistant Secretary hinted the department may step up scrutiny of ERISA plan investments in crypto.

⚖️ A former senior researcher for the Ethereum Foundation plead guilty to violating a law that prohibits US citizens from exporting tech to North Korea, based on a 2019 presentation he gave at a North Korea conference.

🤦 A bug in Compound’s code led to $80M being accidentally sent to various wallets. Maybe Compound can ask Citi for advice.

⚖️ The CFTC settled charges against Kraken over the exchange failing to register as a Futures Commission Merchant and offering margin transactions without registering as a Designated Contract Market.

📈 Coinbase applied to become a Futures Commission Merchant (aka, they want to offer crypto futures).

📝 BIS (an international group of central banks and monetary authorities) released a report on how central banks should think about CBDCs. John Collins over at FinTech Today does a good job summarizing it.

⚖️ OFAC sanctioned a crypto exchange for the first time. Suex, a Russian exchange, allegedly facilitates crypto transactions for ransomware attacks.

📝 Coinbase plans to propose crypto regulations (and, y’know, probably raise the barrier to entry).

🤓 Coinbase’s CCO kicked off an interesting blog post series on how the company drives compliance innovation. The first post looks at crypto usage in terrorist financing. The series feels like a PR move: “Look, we’re so responsible you should enact our proposed regs!”

Sui Generis

In law school, Con Law would have been way cooler if the final involved the Zone of Death.

The FinTech pun of the month award goes to…

I’m a big fan of services that reduce the legal costs for common legal needs (e.g., LegalZoom or HelloDivorce). Had a great chat with Cody over at Trust & Will recently; they’re building something similar and looking for lawyers.

About

Hi. I’m Reggie. I’m a lawyer at BlueVine.

If you want to connect, are raising pre-seed rounds, or are on the FinTech job hunt, come say hi on Twitter or send me an email at: fintechtldr@gmail.com.

Any views expressed are my own (well, sort of? I mean, they’re based on laws and regulations, so they’re not really “mine”?). Nothing here is legal or financial advice.

Here are the foundational FinTech laws and regs if you want a closer look at anything.

Via the Comptroller’s FDIC board seat (the FDIC oversees state banks that aren’t Fed members), and FFIEC membership (an org that, among other things, sets practical financial institution compliance standards), among others.