Hi all 👋

Know any great risk strategists or engineers? Send ‘em Lithic’s way!

This is a longer one, so if your email clips, click here to read in browser.

Ukraine

It’s great to see the financial system’s plumbing front and center on the world stage…but it’s for all the wrong reasons.

I won’t go into detail on the Russia sanctions, their effects, or how SWIFT works since plenty of others have. But if you haven’t yet, please consider donating to Ukraine.

Crypto Exec Order

Better.com isn’t the only one fumbling with delivering news (at what point do they rename to SubPar.com?). Treasury released a statement Tuesday discussing Biden’s Wednesday release of a crypto executive order.

It’s the first crypto order from the White House, and it outlines six initiatives:

Consumer & Investor Protection: Treasury and other agencies will create policy recs to protect consumers and investors.

Financial Stability: The order encourages FSOC (a cross-functional group of financial regulators that monitors systemic risk) to identify crypto risks and develop policy to address regulatory gaps.

The EO calls out issuers, exchanges, and service providers that may not be meeting compliance requirements of “traditional finance.”

Illicit Finance: The order tells agencies to figure out crypto’s illicit finance and national security risks. Think: money laundering, cybercrime, ransomware, drug/human trafficking, and terrorist/weapons financing. The EO focus is on (1) other countries’ gaps in AML/terrorist financing regs, and (2) unaddressed risks in DeFi, crypto payments, and blockchains built without controls.

Promote US Leadership: The order directs Dept of Commerce to create a framework for agencies to help make the US a globally competitive crypto leader, based on US values (democracy, rule of law, privacy, consumer / investor / business protections, and interoperability).

Financial Inclusion: The order cites expensive cross-border transfers and the underbanked as issues crypto might ameliorate. Treasury will work with other agencies to create a report on “the future of money and payment systems,” covering crypto’s implications for economic growth, inclusion, and national security.

The order says inclusion should consider disparate impact risk. That’s a legal buzzphrase that means you’re not just prohibited from overtly discriminating, but you also can’t have discriminatory outcomes (intentional or not). It’s a sometimes controversial approach, so it’s interesting to see it mentioned in the foundational exec order.

Responsible Innovation: The order directs the government to take “concrete steps” to study and support responsible crypto innovation, while prioritizing privacy, security, fighting illicit activity, and reducing negative climate impacts.

CBDC: The order directs government to urgently research and develop a “potential” central bank digital currency, and the US will prioritize international participation so the country can make sure international standards are consistent with US values.

BUT. As with the Fed’s recent CBDC paper, it defines CBDC in a way that means it doesn’t have to be blockchain-based.

Some zoomed-out thoughts:

This order is great, we just needed it like…4+ years ago.

Some folks disagree, but I read the order to have a common theme of: the US really needs to step up here and be an international leader or we’ll lose our role and competitiveness on the global stage. The EO keeps coming back to that message over and over and over. Which is good, because it’s true.

It doesn’t say what new regs should be, or mention new policy positions. But it does create needed urgency.

The real meat and potatoes will start hitting at the end of this year: the order calls for a bajillion reports from various agencies in the coming months and years.

FlexWage Earns EWA Letter

Earned Wage Access (EWA) products are, IMO, one of the more interesting FinTech trends. They’re a better alternative to payday loans.

But a big Q regulators grapple with is how should EWA be regulated?

One approach says EWA kind of looks like loans, right? If an employer’s policy is to pay every two weeks, paying an employee early is, in a way, a $$ advance that needs to be repaid, just like a loan.

But a second approach says: the employee earned those wages! They belong to the employee already! They’re just paid less often for logistical and operational reasons. And that makes it feel less like a loan; it’s just paying out what already belongs to someone.

So far, a few regulators and states have chimed in:

The CFPB released an opinion in 2020 creating a safe harbor for EWA providers who sign up with employers (instead of offering direct-to-employee) (see footnote if you want details ↗️1).

CA entered memoranda of understanding with EWA providers that say the providers can be subject to examination by CA and will give CA regular reports on their products. But, it didn’t say whether the EWAs were credit/loans; it was more of an info-gathering initiative.

A few states like NJ, NY, NV, and others have proposed bills creating safe harbors for EWA providers who contract with employers (again, not direct-to-employee).

As you can see above, one regulatory “axis” for how much scrutiny EWA programs should get is whether the provider offers it directly to employees, or whether it has to sign up with an employer who then offers it to their employees.

The idea here is employers may be more sophisticated and act as gatekeepers; direct-to-employee products are going to be higher risk.

Well, FlexWage, an EWA provider, just received an opinion letter from CA’s financial regulator that says their EWA product isn’t “credit.”2

This is big because CA (1) is a significant regulator and (2) didn’t say the EWA providers in its earlier memoranda weren’t credit.

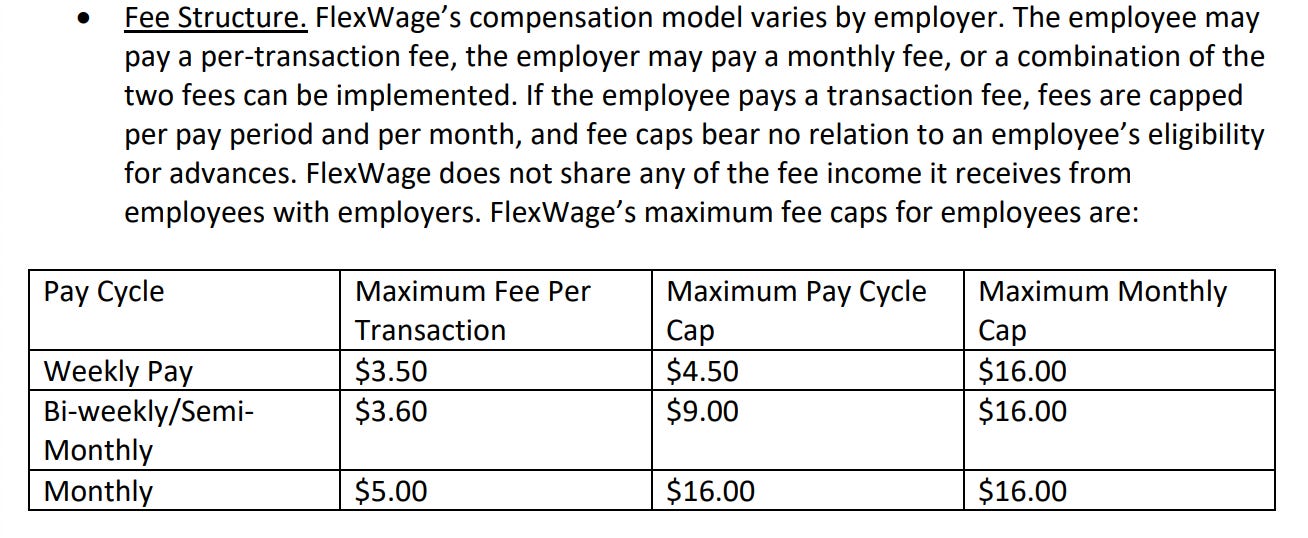

The opinion hinges on two aspects of FlexWage’s model: (1) employers (not FlexWage) provided the advanced funds, which couldn’t exceed what employees earned, and (2) FlexWage’s fees were low enough to suggest they weren’t evading CA’s lending laws.

While it’s driven by FlexWage’s structure, the opinion letter is a vote in favor of putting EWAs in the second bucket of “these wages already belong to the employee, they’re not a loan!”

The opinion also says if FlexWage accepted “optional” payments (read: tipping), their product might be treated differently because that could suggest they’re getting cute and trying to structure “interest” to appear as something else.

One last interesting data point from the opinion: FlexWage users used the service 2.55 times per month.

Zelle’s Fraud

The NYT had a piece this weekend on Zelle’s fraud problem, which big banks seem to be ignoring. I did a Twitter thread on the regs behind the problem + how it could change, which you can read here:

It’s a good reminder to FinTechs about why good customer service should be core to your business:

It’s Not Me, It’s You, FDIC

The former FDIC Innovation Chief, Sultan Meghji, wrote a Bloomberg OpEd that is, uhh, NOT flattering for the FDIC.

He writes:

“The federal bureaucracy is both hesitant and hostile to technological change. America’s global financial leadership is in jeopardy. . . . Lack of expertise is also a problem. I estimate that across the agencies I encountered, less than one-tenth of staff had a basic understanding of the technologies they regulate.”

Auto Lending Scrutiny

Any FinTechs playing in the car lending space should keep an eye on the CFPB’s increasing scrutiny:

They released a compliance bulletin outlining illegal car repo actions the agency has seen recently (like repossessing cars when sufficient payments are made).

Per a related news release, the agency’s concerns are driven by the high prices of cars right now, which incentivize aggressive repos because the cars can be resold for more than the current loan is worth.

The CFPB also released a blog post about how they expect auto debt to increase as a result of inflation, so they’ll be scrutinizing auto lending interest and fees, loan-to-value ratios, and collections.

Elsewhere:

Block (f/k/a Square) is being investigated by the CFPB and several states over Cash App, per Bloomberg. A spokesperson mentioned expanding customer support, so I’m guessing this is driven by something like, for example, not sufficiently responding to transaction disputes.

The CFPB released a report on medical debt, hinting that the agency thinks medical debt shouldn’t be allowed on credit reports. If you want more details, see Fintech Business Weekly’s latest edition.

Consumer advocates in MI added a ballot initiative capping payday loan interest rates at 36%.

The Department of Ed asserted authority over income share agreements for the first time, on the grounds ISAs are private education loans. The announcement was based largely on a 2021 CFPB consent order that categorized an ISA provider as a student lender.

The Student Borrower Protection Center released a report on how BNPL use is increasing in loans to students, likely without lenders having proper compliance in place. The report also highlights and raises questions about PayPal’s on-going lending relationship with for-profit schools. See Polo Rocha’s piece in AmBanker if you want more.

The Fed updated their proposal for which institutions can access Fed payment rails and accounts to include tiers; institutions that are FDIC-insured and/or subject to federal bank regulator oversight will get more streamlined (read: easier) reviews.

The FDIC released its 2021 annual report.

The CFPB and OCC are investigating Bank of America and may bring enforcement actions over BoA’s role as the exclusive provider of prepaid cards for certain benefits (e.g., unemployment). BoA allegedly failed to respond to cardholders who reported unauthorized transactions, and blocked legitimate beneficiaries from accessing their accounts.

American Banker had a good piece outlining the tech that FDIC tech sprints have helped create.

American Banker also published a fun roundup of prepaid card debacles.

Eight federal regulators issued a bulletin encouraging lenders to explore using Special Purpose Credit Programs (SPCPs). These programs give lenders a way to lend to disadvantaged groups, but haven’t historically been used much (and likely still won’t be).

S/o to @jonathansjoshua and @bradford_hardin for chatting with me about SPCPs. If you don’t follow both of them yet, go do it!

Elsewhere (crypto):

The SEC is poking around the NFT market, looking at whether certain NFTs are securities. In particular, the Commission is asking about fractional NFTs. Spoiler alert: fractional NFTs are almost certainly securities.

BitMEX founders plead guilty to violating the Bank Secrecy Act for running the crypto spot and derivatives trading platform with insufficient AML steps.

BitConnect founder Satish Kumbhani is now facing a DOJ indictment (in addition to the existing SEC charges) for his alleged role in defrauding investors of ~2.4B by using BitConnect as a ponzi scheme. And the 11th Circuit reversed a class action dismissal (aka, the case can move forward) against BitConnect for securities fraud.

Remember the staking tax case we mentioned a few editions ago, where the IRS tried to offer a refund for taxes paid on staking to a couple and the couple refused? Well, the IRS is moving to dismiss the case, saying the couple had no right to refuse. If they can get it dismissed, it may leave the taxation of staking in limbo.

Senators are worried crypto can be used to avoid Russia sanctions though, of course, it’s likely too hard to do so.

Chainalysis had a great Twitter thread with their thoughts on crypto’s potential use to evade Russian sanctions. “Overall though, we’re optimistic that the cryptocurrency industry can counter attempts by Russian actors to evade sanctions with crypto.”

See also, Coinbase blocking 25,000 Russian-linked wallets.

The head of NY’s financial regulator announced strengthened sanctions enforcement against Russia that include expediting blockchain analytics tech.

Lugano, Switzerland, will accept BTC and USDT as legal tender, so residents can pay taxes, parking tickets, and other public bills in crypto.

Rep. Gottheimer (D-NJ) released a draft bill that creates a regulatory framework for stablecoins.

Sui Generis (Fun Finds)

Hi. I’m Reggie. I’m a FinTech product lawyer at Lithic

Reach out (email or Twitter) if you’re interested in any of the following:

Sponsoring the newsletter

Early stage fintech looking to raise

Collaborating

Just want to say hey!

Lithic’s hiring if you want to come work with me! And if you’re curious about using Lithic to issue cards to send $, spend $, sponsor your own card program, or anything else, get in touch (fintechtldr@gmail.com).

Any views expressed are my own (well, sort of? I mean, they’re based on laws and regulations, so they’re not really “mine”?). Nothing here is legal or financial advice.

The safe harbor generally requires (1) the EWA provider contracts with the employer, (2) the financed amount can’t exceed the earned wages, (3) employees don’t have to pay (and the EWA provider can’t accept tips or other payment) to access the program, (4) the EWA provider can only get repaid by an employer-facilitated deduction of the next paycheck, (5) the EWA provider can’t go after the employee if the deduction fails, (6) the EWA provider has to give certain disclosures, and (7) the EWA provider can’t use or impact the employee’s credit risk.

It also says FlexWage doesn’t provide deferred deposits for the same reasons it isn’t a loan/credit