Heyo 👋

Lithic is looking for a Head of Sales and Account Exec – send good people our way!

Hope your Valentine’s Day wasn’t filled with love letters from the CFPB.

If your email clips this, click here to read in browser.

BlockFi

We’ve talked about the BlockFi Interest Account (BIA) before, but the gist is:

You deposit crypto,

BlockFi lends your crypto out or uses it for their own trading, and

They pay you some of the $$ they make from step 2 as “interest,” ranging up to almost 10% for some stablecoins.

There are several BIA-like products out there, and regulators aren’t happy:

BlockFi received cease and desist letters from state regulators last summer.

Coinbase wanted to launch a similar product and the SEC said LOL no, we’d come after you.

Celsius and Gemini are reportedly under scrutiny for similar products.

The golden rule for securities is: if you offer and sell them, you need to register the securities with the SEC (or fit an exemption). So this attention is focused on whether BIA-like products are securities. And the crypto companies, of course, argue they’re not securities, but more like (uninsured) high-interest savings accounts.

If you look at BlockFi’s BIA, squint really hard, and don’t think too much about what makes something a “security”, then it kind of looks like…you’re squinting really hard a security.

I’m not saying BIA products should be regulated like securities. But I think a general sniff says yep, it’s a security (see this September post for the legalese).

Welp, BlockFi agreed to settle and pay $100M to the SEC and state regulators to resolve claims its BIA was an unregistered securities offering (you can stop squinting at it now).

So. Much. To. Say.

First

BlockFi will register the BIA as a security with the SEC. It could be a while before the SEC approves their filing, and the SEC might not actually approve it?

I’d guess it’s more likely than not to be approved eventually, but this will be the first BIA-like product offering filed with the SEC and they have a history of dragging feet on crypto decisions.

Second

Existing users are allowed to keep their BIA accounts and will still earn interest. They can’t add new tokens, or return tokens once they remove them from a BIA. This is kind of a good sign? The SEC could have made them shut down the BIA, but it gave them a hall pass.

Third

Coinbase’s CEO, Brain Armstrong, has to be so pissed.

Armstrong had a very public tantrum about how the SEC was being “sketchy” over Coinbase’s BIA-like product. Coinbase was pushing to get the product classified as a non-security…and here BlockFi waltzed in saying “sure, we’ll happily treat this like a security!”

I’ve heard of regulators going after small fish (who may not have $$ to defend themselves) to prove a legal theory before going after big co’s. But this settlement is a good example of going after a more “compliant” fish, and now the SEC has the precedent it wanted. This may have factored into why BlockFi was able to settle without admitting guilt. 🤔

Fourth

BlockFi doesn’t pay its PR company enough.

One way to present the news is to say this was a “settlement” and huge fine for violating securities laws that have been on the books since the early 1930s.

Another way to describe it is like this:

BlockFi makes it sound like they amicably held hands with the SEC while skipping down a yellow-brick road to a new regulatory invention. “Pay no attention to the $100M fine behind the resolution!”

BlockFi didn’t get clarity. They cried uncle and gave into what the SEC and securities lawyers have been saying all along.

If you want more legalese: the order says (1) the BIA was a security under both the Howey and Reves tests, and (2) BlockFi was an investment company since >40% of its assets were BIA securities.

Fifth

Securities registration is a regulatory moat; it can be expensive. BlockFi didn’t just give in to the SEC, they made it more expensive for anyone that wants to launch a BIA-like product.1

Sixth

What’s next for BIA-like products? A few possible paths:

They follow BlockFi’s steps and register as securities.

They don’t register and fight the SEC when they come knocking.

They offer BIA-like products as securities that are exempt from registration (which means restrictions like only high net worth people can use them).

They lobby for new laws and rules.

???

Profit

Privilege Is a Privilege

“Attorney-client privilege” is the idea that convos between lawyers and their clients are sacrosanct. It means, if you end up in court, the other side can’t force your lawyer to disclose what you told them.

The idea is lawyers can only represent clients well when they know all the information (like where the (hopefully figurative) bodies are buried). And clients will only tell their lawyers everything if they can trust their convos will remain confidential.

But one thing most reasonable people (non-lawyers) don’t know is you can totally screw up privilege.

Which brings us to the SEC lawsuit against Ripple. Ripple Labs is a crypto company trying to build an international payment settlement system using the XRP token. And in late 2020, the SEC sued Ripple and two execs, claiming XRP was a security, so XRP' sales were unregistered securities offerings.

This is a big case for crypto.

We won’t go into the details here, but the outcome may be a big, new guidepost for when a token is a security vs. not.

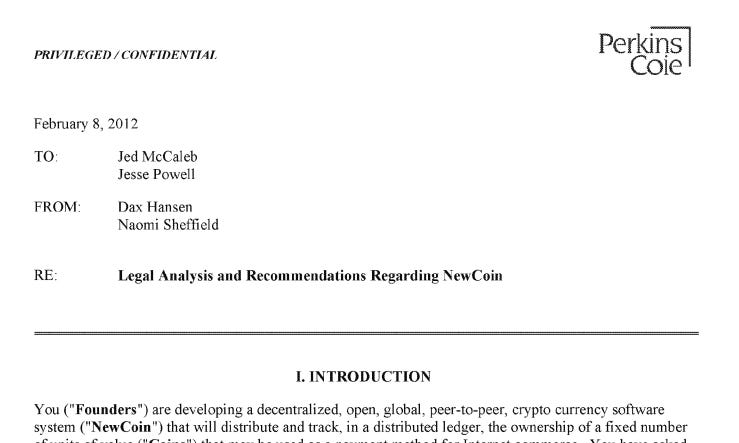

The more interesting part is last Friday two memos from Ripple’s law firm were unsealed. These memos get to the heart of whether XRP is a security. For example, if Ripple knew the SEC would call it a security, it’s…hard to come back from that?

The memos are clearly labeled “privileged” and “confidential,” and are addressed only to folks at Ripple:

Privilege belongs to the client; if the lawyer screws it up, they can face serious ethical consequences. Clients can break privilege if they want, that’s fine. The point of the Ripple suit is clients shouldn’t unintentionally blow privilege.

Two common ways clients screw it up are:

Talking about the privileged thing in the presence of third parties, and

Disclosing the privileged thing to third parties (consultants, auditors, board observers, a DoorDash delivery driver; via forwarding an email, telling your friends, etc).

And it turns out Ripple shared the memos with potential investors.2 Whoops.

When privilege is broken, it’s not just the memos that the SEC can uncover. All correspondence Ripple had with legal counsel is probably fair game.3

And the memo content? The gist is: (1) the Feb 2012 memo warns XRP would likely be securities if sold to investors and (2) the Oct 2012 memo says XRP may not be a security, but warned the SEC might disagree (spoiler: it does).

(H/t to Margaret Rosenfeld from K&L Gates for putting this on my radar).

Lending Partnerships

OCC & FDIC Rules

We talked about lending fintech-bank partnerships last edition, but focused on the “true lender” approach. That one asks: based on factors like program oversight and who holds the economics of the loan, who is the real lender? If it’s the bank, then the loan can preempt state interest rate caps. If it’s the bank partner, then it can’t.4

There’s a second way to attack bank partners: valid when made (VWM). This one says: if the interest rate was “valid” when the bank made the loan, it’s still valid after the bank sells or assigns the loan. Which means a non-bank partner can preempt state interest rate caps (because bank itself can preempt).

Back in 2015, in a case called Madden, the Second Circuit undercut VWM by saying a non-bank buyer couldn’t inherit the interest rate preemption of the bank. That created a ton of uncertainty, so the OCC and FDIC released interpretive guidance that reaffirmed VWM.

CA, IL, and NY didn’t like that; they want to be able to stop payday lenders that charge 500% APR, and these OCC and FDIC rules bolster a way around their interest rate laws. So they sued, claiming the OCC and FDIC went outside of what they have authority to make rules about.

Welp, a CA District Court just rejected those challenges.

Generally, this generally is a good sign for FinTech-bank partnerships; it bolsters certainty over VWM.

But.

The partnership model can still be attacked via the true lender doctrine, and Michael Hsu, the head of the OCC, released a statement after the court decision saying “predatory lending has no place” and the OCC is committed to ensuring banks aren’t used for “rent-a-charter” arrangements.

So, if you’re a lending FinTech, you’ll want to watch for “true lender” news, like…

Elevate & New Mexico

First, DC announced a settlement with online subprime lender Elevate over claims it charged interest that exceeded the state’s usury cap:

Elevate charged as much as 250% or more in interest.

DC’s complaint alleged Elevate was the “true lender” so it couldn’t rely on their bank partners’ interest rate preemption.

Second, New Mexico just approved a bill5 that caps interest at 36% on loans under $5K. But it provides a “true lender” exception where a bank maintains the “predominant economic interest” in the loan (meaning, for example, the bank holds 51% of the loan’s economic risk/profit).

That sounds good, but it’s kind of hostile to how many lending bank partnerships work in practice; the bank often doesn’t hold most of the economics.

Canada Convoy

Financial services were pulled into the Canadian trucker protests:

Canada invoked a law that allows the government to freeze or suspend bank accounts without a court order.

Canada broadened the scope of their AML laws to cover crowdfunding platforms and payment service providers used to support protesters.

A class action suit brought by plaintiffs personally affected by the protests successfully got a court injunction freezing convoy participants’ crypto.

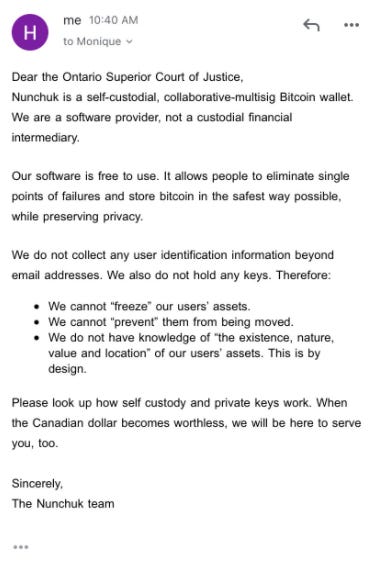

The Ontario Superior Court sent Nunchuk (a self-hosted crypto wallet provider) an injunction to freeze and disclose info about crypto tied to the convoy. To which Nunchuk responded…

Elsewhere

LA’s district attorney is pressuring the card networks to blacklist payments for gun-building kits.

The Fed released a toolkit to help banks fight synthetic identity fraud.

The CFPB launched an email for anyone to submit petitions to make, amend, or repeal rules. Do they know what they’re asking for? Has anyone there even met the internet?

Amazon and Visa resolved their face-off over Visa’s interchange fees.

The CFPB may rethink its Earned Wage Access guidance.

The IRS canceled its plans to use facial recognition tech to authenticate taxpayers accessing their accounts on the IRS’s website. Not before 7 million Americans submitted their face scans, though.

New director, who dis? The FDIC released its ‘22 priorities: revamping the Community Reinvestment Act, climate change risks, bank mergers, crypto risks, and finalizing updated capital requirement rules.

Chime and Meta filed a joint suit against individuals behind a Facebook phishing scam. It’s the first joint complaint Meta has ever filed with a financial services company.

The CFPB published a table comparing large banks’ overdraft and NSF practices. This builds on a recent regulatory theme of publicly shaming companies.

The CFPB is keen to scrutinize student debt collectors who mislead borrowers about public service loan forgiveness.

The UK’s financial regulator is making four BNPL companies change their terms and conditions on cancellation and payment authority, to make them fairer and easier to understand.

The SEC proposed rules that would shorten the securities settlement cycle from T+2 to T+1.

A DC Court of Appeals heard oral arguments in PayPal’s case challenging the CFPB’s Prepaid Rule. Don’t worry if that’s gibberish; we’ll explain more when a decision comes down.

@PolicyPitts did a great Q&A in Protocol on open banking.

Sarah Bloom Raskin, Biden’s nomination for vice chair of supervision at the Fed (super important role overseeing bank regulation and supervision), is getting thwarted by Senate Republicans due to her climate views and business ties.

Elsewhere (crypto):

Eighteen big names in crypto announced an AML data sharing platform called TRUST to address the travel rule (aka, the need to pass on info about an account holder for transactions >$3K). This might end up being a phenomenal KYC platform that could enable, say, skipping KYC when you sign up somewhere if that company is part of the TRUST platform.

Honestly, you’ve almost certainly heard about it by now, but $3.6B of bitcoin was seized by the DOJ and the, err, “colorful” couple (“allegedly”) behind the hack were arrested. Boy, it’s sure annoying when the government can see who a crypto wallet belongs to ¯\_(ツ)_/¯

Treasury signaled that miners and stakers won’t face tax reporting obligations in a letter to senators.

The SEC is scrutinizing Binance’s relationships with two market making crypto firms that trade on the platform.

Divorcing couples are grappling with dividing crypto more and more.

A Bitcoin miner ETF was approved with the ticker WGMI.

The head of the CFTC testified before a Senate Committee on crypto, re-iterating the agency’s view that they should oversee crypto spot markets (“also please give us lots of money to do that”).

The UK’s tax authority made the first-ever NFT seizure after arresting three people for fraud.

Colorado will accept tax payments in crypto.

The FBI launched a new crypto crimes unit to investigate ransomware and other crimes that use crypto.

IL and GA proposed tax incentives for BTC miners.

Sui Generis

Phenomenal climate change satire: Man Announces He Will Quit Drinking by 2050:

“The program will see Greg . . . reduc[e] consumption in 2049 when he turns 101.”

“‘It’s not realistic to transition to zero alcohol overnight. This requires a steady, phased approach where nothing changes for at least two decades,’ he said, adding that he may need to make additional investments in beer consumption in the short term, to make sure no night out is worse off.”

Hi. I’m Reggie. I’m a FinTech product lawyer at Lithic

Reach out (email or Twitter) if you’re interested in any of the following:

Sponsoring the newsletter

Early stage fintech looking to raise

Collaborating

Just want to say hey!

Lithic’s hiring if you want to come work with me! And if you’re curious about using Lithic to issue cards to send $, spend $, sponsor your own card program, or anything else, get in touch (fintechtldr@gmail.com).

Any views expressed are my own (well, sort of? I mean, they’re based on laws and regulations, so they’re not really “mine”?). Nothing here is legal or financial advice.

Ofc, many crypto companies will launch their products without regard for needing to register, so I expect you’ll be able to find unregistered BIA-like accounts if you went looking.

Early in the case, Ripple claimed the memos were privileged, but they’ve stopped claiming that and didn’t push back on the SEC’s motion to unseal the memos on privilege grounds.

That’s not always the case, but it appears to be in Ripple’s case.

This is a little bit of an oversimplification.

The NM law needs to be signed by the governor before it goes into effect, but that’s expected.